Deciphering the Cost of Legal Funding: What You Need to Know About Interest Rates and Fees

In the complex world of legal battles, the financial strain can be overwhelming. Lawsuit funding, often referred to as loans on lawsuits, provides a vital lifeline for individuals awaiting settlements. However, navigating the intricacies of interest rates and fees associated with these loans requires a steady hand and an informed mind. This guide aims to empower you with the knowledge necessary to make sound decisions when assessing lawsuit loan providers.

The Basics of Lawsuit Funding

Lawsuit funding is a non-recourse financial arrangement where a lender provides cash advances to plaintiffs based on the expected outcome of their lawsuit. These funds are especially beneficial for individuals facing monetary difficulties due to prolonged legal proceedings. Unlike traditional loans, repayment is contingent upon winning the case, making them a low-risk option for plaintiffs.

Understanding how these loans work is crucial. Primarily, they provide financial breathing space, allowing plaintiffs to cover living expenses, medical bills, and legal fees while awaiting settlement. However, the convenience comes at a cost, often in the form of interest rates and fees that can vary significantly among providers.

Why Interest Rates Matter

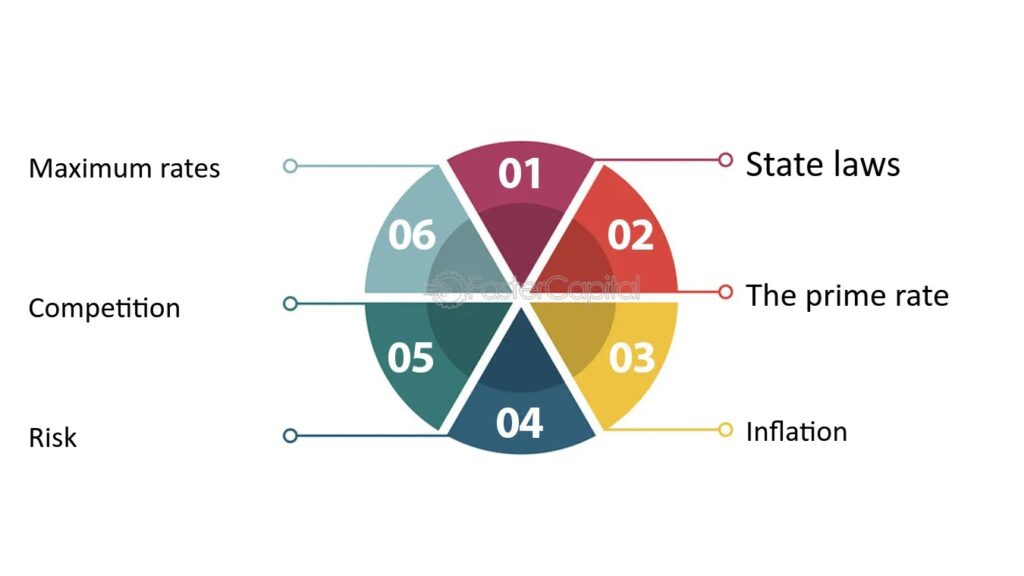

Interest rates are the heart of any lending arrangement. In the context of lawsuit funding, they determine the cost of borrowing over time. Typically, these rates are higher than those for conventional loans due to the inherent risks lenders face. Plaintiffs should compare rates from multiple providers to ensure they’re getting a competitive deal.

Rates are generally structured as either simple or compounded. Simple interest involves calculating interest on the original loan amount, while compounded interest, which can be monthly or quarterly, accrues interest on both the principal and accumulated interest. Understanding this distinction is critical, as it significantly impacts the total repayment amount.

Unraveling the Complexity of Fees

In addition to interest, lawsuit loan providers often charge various fees. These can include origination fees, underwriting fees, and processing fees. Origination fees cover the cost of setting up the loan, while underwriting fees compensate for the risk assessment conducted by the lender. Processing fees, on the other hand, are incurred for handling the transaction.

It’s vital to read the fine print and ask providers to clarify any fees you don’t understand. Hidden fees can substantially increase the cost of borrowing, so transparency is key. By understanding the fee structure, you can make informed decisions about whether a particular loan is right for you.

Comparing Loan Providers

When selecting a lawsuit loan provider, comparison shopping is essential. Look for lenders with favorable interest rates and a transparent fee structure. Check reviews and request client testimonials to gauge the company’s reputation and level of customer satisfaction. This process can help ensure that you’re partnering with a reliable and trustworthy provider.

Additionally, comparing funding terms such as the length of the loan and any prepayment penalties is crucial. Some lenders may offer flexible repayment options, allowing you to reduce costs by paying back the loan early. Others might impose hefty fees for early repayment. Understanding these terms upfront can prevent unexpected financial burdens down the road.

The Role of Professional Advice

Engaging a financial advisor or attorney can be beneficial when assessing loans on lawsuits. They can provide insights into the terms and conditions of different loans and help you understand the long-term financial implications. Their expertise can be invaluable in ensuring you make informed decisions that align with your financial goals.

Professional advice is particularly important if your case involves complex legal issues or if you’re considering a significant loan amount. An advisor can help you assess whether the funding is necessary and whether the terms offered are reasonable given your situation and anticipated settlement amount.

Understanding the Risks

While lawsuit funding offers financial relief, it’s important to understand the potential risks. High interest rates and fees can erode a significant portion of your settlement, leaving you with less than anticipated. Additionally, if your case takes longer than expected to settle, the cost of borrowing can increase, impacting your financial well-being.

Being aware of these risks allows you to take proactive steps to minimize them. For instance, negotiating better terms with your lender or exploring alternative funding options can help reduce costs. By staying informed, you can protect yourself from potential financial pitfalls.

Evaluating Your Financial Needs

Before seeking lawsuit funding, it’s crucial to evaluate your financial needs thoroughly. Consider whether you can cover expenses without external funding or if a smaller loan amount would suffice. This assessment can help you avoid borrowing more than necessary, thereby reducing your overall interest and fee obligations.

Taking stock of your current financial situation, including your existing debts and income sources, can provide a clearer picture of your funding requirements. By aligning your borrowing with your actual needs, you can make more strategic decisions about lawsuit funding.

The Impact of Settlement Delays

Settlement delays are common in legal proceedings and can affect the cost of lawsuit loans significantly. Longer cases mean more interest accrual, raising the total repayment amount. Understanding how potential delays might impact your loan cost is essential when negotiating terms with lenders.

Discussing potential timelines with your attorney can provide an estimate of how long your case might take to resolve. Sharing this information with your loan provider may help negotiate terms that accommodate potential delays without excessive financial penalties.

Making Informed Decisions

With a clear understanding of interest rates, fees, and the nuances of lawsuit loans, you’re better equipped to make informed decisions. Knowledge empowers you to negotiate better terms, select reputable lenders, and manage your finances effectively throughout the legal process.

Assess each offer comprehensively, considering both the immediate financial relief and long-term cost implications. By making informed decisions, you can confidently secure the funding needed to support your legal battle without compromising your financial future.

Leveraging Settlement Proceeds Wisely

Once your case settles and you receive your funds, managing them wisely is crucial. Prioritize paying off any outstanding debts, including your lawsuit loan, to minimize interest accumulation. Consider consulting a financial advisor to develop a plan that maximizes your settlement’s long-term value.

Using settlement proceeds strategically can ensure they provide lasting financial benefits. Whether it’s investing in future opportunities or securing your financial well-being, thoughtful planning can help you make the most of your hard-earned settlement.

The Future of Lawsuit Funding

The landscape of lawsuit funding is continually evolving, driven by changes in legal frameworks and market dynamics. Staying informed about industry trends and developments can help you anticipate shifts that might impact your funding options and financial strategy.

Following industry news and engaging with professional networks can provide valuable insights into the future direction of lawsuit funding. By staying ahead of trends, you can adapt your approach and make proactive decisions that support your long-term financial success.

Interest rates and fees play a pivotal role in assessing lawsuit loan providers. Understanding these elements helps safeguard your financial well-being as you pursue justice. By making informed decisions, comparing providers, and leveraging professional advice, you can achieve financial stability and focus on what matters most—winning your case. For further assistance and resources, consider exploring additional guides or consulting financial experts to enhance your understanding of lawsuit funding.